I realize that it’s downright chic to dismiss broadcast television as a dying industry, especially since every time Nielsen offers up new data its Gauge its share of measured viewing continues to decline. Given what little has been on this summer to spike it–heck, even BIG BROTHER is relatively meh compared to prior seasons–I strongly suspect that story will be blazed out with yet another another all time low headline across whatever trade and mainstream media is looking for clickbait.

But ask those who actually care the most about those deliveries–the advertisers and the platforms that rely upon that revenue to meet their business objectives–and they’ll croon a different tune. Because when it comes to impressions–the number of exposures a message receives–broadcast television–epseically local TV–is still is a significant business. And thanks the attitude of the current FCC leadership–not to mention the political landscape that attitude ignites–it’s apparent that it’s only gonna get even more so.

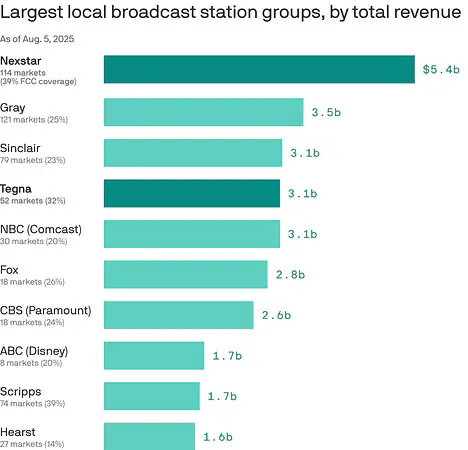

And that’s why this otherwise overlookable chart that accompanied a story ostensibly about 800-pound gorillas caught my eye that if you’re looking for a winner that will assuredly emerge from the midterm election cycle you should be paying attention to the recently rechristened Gray Media.

And that’s why this otherwise overlookable chart that accompanied a story ostensibly about 800-pound gorillas caught my eye that if you’re looking for a winner that will assuredly emerge from the midterm election cycle you should be paying attention to the recently rechristened Gray Media.

If you live in a big coastal elite city you may not be familiar with them. Their largest current market is Atlanta, and they are losing their CBS affiliation there on Monday, when New Paramount claws back that asset to its thankfully digitally renumbered station known as legacy Channel 69. Feel free to insert your own punch line there. But what this chart from AXIOS Media Trends reveals is that not only does Gray currently reach more different markets than any other major broadcaster, they’re also generating more revenue than all but one of them.

So while the story from Sara Fischer and Dan Primack focused on more familiar monoliths, I encourage you to pay close attention to the last bullet:

Sinclair has launched a strategic review of its broadcast business, which includes 178 television stations in 81 markets.

Why it matters: The broadcasting industry appears to be starting a new game of musical chairs, as Sinclair’s announcement comes just days after a WSJ report that Nexstar is in talks to acquire Tegna.

Why it matters: The broadcasting industry appears to be starting a new game of musical chairs, as Sinclair’s announcement comes just days after a WSJ report that Nexstar is in talks to acquire Tegna.

The big picture: Any of these deals could run into FCC ownership cap issues, but there’s a sense that FCC chair Brendan Carr would issue temporary waivers on the assumption that they plan to raise the ownership cap threshold.

- The E.W. Scripps Company and Gray Media’s recently announced deal to swap television stations in five local markets — forming rare duopoly ownership in several places — is being seen as a strong litmus test.

You might have also seen Gray in the news earlier this week when it helped bail out an old–er, seasoned–friend of ours that wasn’t quite able to crack this whole local TV business as well as he’s been able to attack other aspects, a story big enough for VARIETY’s Jennifer Maas to amplify:

Byron Allen’s Allen Media Group, Inc. has sold 10 local TV stations to Gray Media for $171 million. The deal, which Gray expects to close in the fourth quarter subject to regulatory approval and closing conditions, will bring Gray into three new local TV markets: Columbus-Tupelo, Mississippi; Terre Haute, Indiana; and West Lafayette, Indiana. Per Gray, the sale is expected to “strengthen the company’s presence in the seven other markets by creating new duopolies that would allow Gray to preserve and deepen public service to their communities with expanded local news, local weather, and local sports programming.” Local TV stations included in the deal are:

Byron Allen’s Allen Media Group, Inc. has sold 10 local TV stations to Gray Media for $171 million. The deal, which Gray expects to close in the fourth quarter subject to regulatory approval and closing conditions, will bring Gray into three new local TV markets: Columbus-Tupelo, Mississippi; Terre Haute, Indiana; and West Lafayette, Indiana. Per Gray, the sale is expected to “strengthen the company’s presence in the seven other markets by creating new duopolies that would allow Gray to preserve and deepen public service to their communities with expanded local news, local weather, and local sports programming.” Local TV stations included in the deal are:

75 Huntsville, AL WAAY (ABC)

90 Paducah-Cape Girardeau-Harrisburg WSIL (ABC)

109 Evansville, IN WEVV (CBS/FOX)

110 Ft. Wayne, IN WFFT (FOX)

121 Montgomery, AL WCOV (FOX)

124 Lafayette, LA KADN (FOX/NBC)

No, these are not the most major league markets out there. But the duopoly (and, in some case, tri- and quad-opoly) strategy is how Nexstar and Sinclair have built their businesses and is the impetus for the lobbying of the likes of Carr to allow them and anyone else interested to be able to own a larger U.S. footprint than some outdated law dating back to the Reagan administration currently dictates they can’t. In a majority of Gray’s markets, that’s their strategy–even doing so with some lower-risk options such as historically low-power and Spanish-language stations that via digital distribution immediately reach parity.

With Nielsen FINALLY ready to release more inclusive local data that factors in non-linear viewership (and Comscore claiming they already can) that means the ability to aggregate impressions has never been better. And in a pivotal midterm election year, local TV provides more avails, targeted reach by state and collectively more different content that isn’t being duplicated on national streaming services–which, incidentally, still compromises a large proportion of viewership to the likes of Hulu, Paramount Plus and Peacock.

And while the most obvious assumption could–and should be–some sort of Nexstar and Sinclair deal, even those entities couldn’t pass federal muster or necessarily manage their combined assets effectively without finding some other entity to take care of some of it. Gray seems to have both money and opportunity to jump into the fray. And given how well Gray’s been doing in their at bats–and that includes a couple of local sports efforts that have replaced failed Sinclair RSN strategies in not-so-insignficant markets such as Phoenix and New Orleans, it’s easy to see why they may be a more attractive partner to someone like Nexstar.

One other note that could assist public sentiment. Many of Gray’s smaller markets represent the kinds of “news deserts” that are potentially being most impacted by the impending demise of the Corporation for Public Broadcasting. Since they already have boots on the ground in many of these areas, they are best positioned to use their own local talents–perhaps augmented by some of the displaced former voices of NPR and PBS outlets–to fill those voids. An audio-only or even video-supported version of what was once the purview of non-commercial stations would go a long way to quelling fears of impending disaster. Having the resources of larger markets to help round it all out only makes this possibility all the more feasible.

So go right ahead and focus on the bigger names if you must. I for one have always found gray–all fifty shades of it–to be a lot sexier to watch.

Until next time…