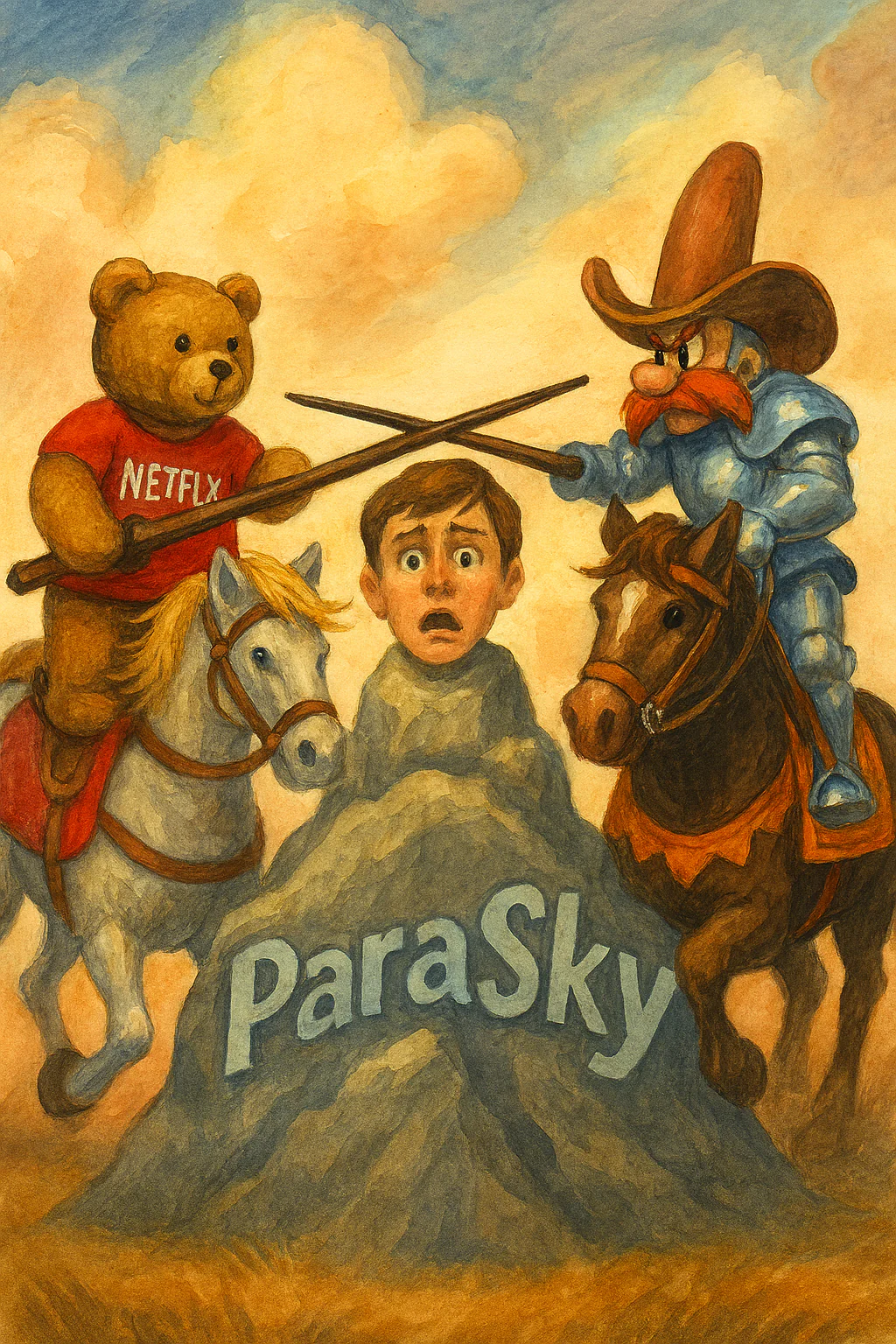

The battle for Warner Brothers Discovery just shifted into fourth gear late last night, when news began to trickle out that despite the white-hot passion and intense lobbying that Paramount Skydance has demonstrated over the past few weeks–and even though he’d had been guaranteed a platinum parachute and a future role–our buddy Yosemite Zas and his henchmen chose the hot young vixen over the seasoned pro. Per THE WRAP’s Roger Cheng:

The battle for Warner Brothers Discovery just shifted into fourth gear late last night, when news began to trickle out that despite the white-hot passion and intense lobbying that Paramount Skydance has demonstrated over the past few weeks–and even though he’d had been guaranteed a platinum parachute and a future role–our buddy Yosemite Zas and his henchmen chose the hot young vixen over the seasoned pro. Per THE WRAP’s Roger Cheng:

Warner Bros. Discovery is moving forward with exclusive deal talks with Netflix, TheWrap has learned. WBD has selected Netflix after the streaming giant offered $30 a share for the studio and streaming assets, according to two people familiar with the deal talks. The deal also includes a $5 billion break-up fee to match the terms that Paramount added with its bid. Netflix securing a win over rival suitors Paramount and Comcast represents a stunning turnaround from just two months ago, when co-CEO Greg Peters shaded big media mergers as not having an “amazing track record,” and Paramount buying WBD seemed like a foregone conclusion. Fast forward to today, and Netflix has won a furious M&A bake-off after three rounds of bids.

Warner Bros. Discovery is moving forward with exclusive deal talks with Netflix, TheWrap has learned. WBD has selected Netflix after the streaming giant offered $30 a share for the studio and streaming assets, according to two people familiar with the deal talks. The deal also includes a $5 billion break-up fee to match the terms that Paramount added with its bid. Netflix securing a win over rival suitors Paramount and Comcast represents a stunning turnaround from just two months ago, when co-CEO Greg Peters shaded big media mergers as not having an “amazing track record,” and Paramount buying WBD seemed like a foregone conclusion. Fast forward to today, and Netflix has won a furious M&A bake-off after three rounds of bids.

It would be simplistic and indeed not wholly accurate to simply chalk this up to yet another example of “money talks, bullsh-t walks”. Because it’s eminently clear that there’s a ton of said excrement that’s still on the scene, and today quite a bit more oozed from practically every entity directly or tangentially impacted by this turn of events.

For one, Paramount ain’t the least bit happy, and they’re making sure you and their friends in high places know about it. The dynamic DEADLINE duo of Dominic Patten and Jill Goldsmith weighed in with that storyline:

Paramount has argued that it was the only one of the three with a clear path to closing, insisting in a letter to WBD that the rival offers from Netflix and Comcast both “present serious issues that no regulator will be able to ignore.” It believes Netflix, being the dominant streamer in the U.S. and globally, would face major antitrust hurdles adding HBO Max to the fold.

David Ellison’s company also called the sale process unfair and tilted towards Netflix. WBD countered that its board “attends to its fiduciary obligations with the utmost care, and that they have fully and robustly complied with them and will continue to do so.” In a veiled attack on WBD CEO David Zaslav, Paramount claimed the “sales process has been tainted by management conflicts, including certain members of management’s potential personal interests in post-transaction roles and compensation as a result of the economic incentives embedded in recent amendments to employment arrangements.”

David Ellison’s company also called the sale process unfair and tilted towards Netflix. WBD countered that its board “attends to its fiduciary obligations with the utmost care, and that they have fully and robustly complied with them and will continue to do so.” In a veiled attack on WBD CEO David Zaslav, Paramount claimed the “sales process has been tainted by management conflicts, including certain members of management’s potential personal interests in post-transaction roles and compensation as a result of the economic incentives embedded in recent amendments to employment arrangements.”

VARIETY’s Todd Spengler provided some additional verbatim details:

Paramount has a credible basis to believe that the sales process has been tainted by management conflicts, including certain members of management’s potential personal interests in post-transaction roles and compensation as a result of the economic incentives embedded in recent amendments to employment arrangements,” the Dec. 3 letter from Paramount Skydance lawyers to Zaslav said. The Paramount letter also alleged that “It has become increasingly clear, through media reporting and otherwise, that WBD appears to have abandoned the semblance and reality of a fair transaction process, thereby abdicating its duties to stockholders, and embarked on a myopic process with a predetermined outcome that favors a single bidder.”

It’s quite clear that there’s bad blood between the dueling Davids, but as STATUS’ Oliver Darcy reminded in his newsletter from last night, that’s apparently been the case for a tad longer than those merely covering this sales process seem to have assumed:

| Over the summer, David Zaslav was deep in negotiations with Paramount over “South Park,” hoping to extend HBO Max’s licensing deal for the popular program. For the previous five years, Trey Parker and Matt Stone’s powerhouse comedy show had streamed exclusively on the Warner Bros. Discovery platform after the episodes aired on Paramount’s Comedy Central, serving as an audience magnet for the service. Zaslav, naturally, wanted to keep the popular series in the fold. |

During the talks, Zaslav floated an unconventional idea: a 10-year, $1 billion licensing agreement that would not grant HBO Max exclusivity. Instead, he proposed co-sharing the rights with Paramount, a structure that both surprised and delighted the Paramount side. But David Ellison, the then-incoming Paramount chief who inserted himself into the negotiations, suggested a tweak. He wanted to cut the term from ten years to five—an ask Zaslav ultimately accommodated, though the licensing fee would also be cut in about half. At that point, the two sides had what amounted to what was believed to be a handshake agreement. |

| Then Ellison reversed course. Apparently unhappy with the price Paramount received for “South Park” in its broader arrangement with Parker and Stone, Ellison relayed to WBD that it would need to absorb half the additional cost, Status has learned. Parker and Stone even offered to cover the costs to get a deal done, but the idea was rejected by Paramount. The eleventh-hour drama blindsided WBD, which thought it had a deal all but inked, and left Zaslav irritated and increasingly distrustful of Ellison, Status has learned. Paramount later announced a direct deal with Parker and Stone, making Paramount+ the exclusive streaming home for “South Park” and prompting the removal of all 26 seasons from HBO Max. |

But the doth protest from Ellison and crew wasn’t the only rhetoric being e-mailed around Hollywood and Washington last night. Spangler’s comrade-in-arms Matt Donnelly weighed in with this:

A consortium of top industry players have sent an open letter full of alarm to Congress, describing a potential economic and institutional meltdown in Hollywood if Netflix succeeds in its effort to acquire Warner Bros. Discovery.

The letter was sent via email to members of Congress from both parties on Thursday, from an anonymous collective identifying themselves only as “concerned feature film producers.” The group explained it was leaving the letter unsigned “not out of cowardice” but fear of retaliation, given Netflix’s considerable power as a buyer and distributor. Netflix and Warner Bros. Discovery declined to comment.

The communication outlines three areas of great concern, including that Netflix could stand to “destroy” the theatrical film marketplace by escalating or eliminating the amount of time Warner Bros. films would play in theaters before hitting a combined Netflix-HBO Max streaming platform. Sources told Variety earlier on Thursday that Netflix’s current proposal for Warner Bros. would have a theatrical window as thin as two weeks of exclusivity before moving to streaming. Another insider familiar with the deal process flatly denied this, saying the periods would be longer.

And Cheng’s colleague Alyssa Ray added this one:

Theater owners voiced their displeasure over Netflix’s successful bid for Warner Bros. Discovery, slamming the news as an “unprecedented threat” to the movie business. Cinema United, the world’s largest exhibition trade association that represents over 30,000 movie screens across the country, weighed in on Netflix’s winning bid for Warner Bros Discovery Thursday evening, and made it clear they opposed the pending acquisition.

Theater owners voiced their displeasure over Netflix’s successful bid for Warner Bros. Discovery, slamming the news as an “unprecedented threat” to the movie business. Cinema United, the world’s largest exhibition trade association that represents over 30,000 movie screens across the country, weighed in on Netflix’s winning bid for Warner Bros Discovery Thursday evening, and made it clear they opposed the pending acquisition.

So it’s clear where the rooting interest lies for these constituencies. And there’s more than just a tinge of irony that they seem to be in goosestep with the very administration their members can’t seem to restrain themselves from railing against and joining pep rallied to protest.

And I dredge that tired point only up because in the wake of recent gun-jumping on the part of other members of the Ellison family that we mused about as recently as earlier this week that Yosemite Zas seeking his own retribution is throwing a monkey wrench into their plans for same.

But I might have an olive branch to offer these spoiled nearly octogenarian brats. As Patten and Goldsmith also pointed out:

Global Networks, or the businesses that would likely not go to Netflix, include entertainment, sports and news television brands and channels globally including CNN, TNT Sports, Discovery networks, top free-to-air channels across Europe, the Discovery+ streaming service and Bleacher Report.

How’s about they team up for a separate business to scoop up those old school assets and run them directly? If you must, indirectly attach it to Paramount Skydance for infrastructure support but keep it at arms’ length–say, like Versant? Their nonogenarian buddy Rupert Murdoch is still running and launching newspapers, for crissakes. If nothing else, it’s got a damn sight more potential than the DOA TMNT+. Yeah, I’ve got an even longer memory than does Zaslav.

How’s about they team up for a separate business to scoop up those old school assets and run them directly? If you must, indirectly attach it to Paramount Skydance for infrastructure support but keep it at arms’ length–say, like Versant? Their nonogenarian buddy Rupert Murdoch is still running and launching newspapers, for crissakes. If nothing else, it’s got a damn sight more potential than the DOA TMNT+. Yeah, I’ve got an even longer memory than does Zaslav.

Say what you will about how preposterous you may think that radical thought is. But it’s apparently nowhere near as radical as Netflix throwing money around like a drunk in a strip club. Isn’t that true, Sons of Democracy?

One thing’s for sure. There’s gonna be a lot of chatter–and probably some stock price volatility–during this “exclusive window”. Settle in, gang. Looks like the off-season just got postponed.

Until next time…