We’re expecting another stormy day in So Cal today, and if you happen to be one of the survivors who’s made it this far into Warner Brothers’ second century of existence that fact is true about more than merely the weather. Because when the skies are scheduled to open up this afternoon while nothing definitive is expected we’re gonna know if this classic look for our pal Yosemite first seen in the classic theatrically released SAHARA HARE seventy summers ago indeed turns out to be prescient. THE WRAP’s PRO-tagonist Roger Cheng set up the pins in his newsletter from last night:

We’re a day away from Warner Bros. Discovery’s deadline for first-round bid submission, and the M&A saga took another turn. For weeks, there’s been chatter of Saudi Arabia somehow getting into the mix, and now we have a clearer picture of that. Paramount is in talks with Saudi Arabia’s Public Investment Fund (PIF), the Qatar Investment Authority (QIA) and the Abu Dhabi Investment Authority (ADIA) about teaming up on a bid for all of WBD, according to people familiar with the situation.

We’re a day away from Warner Bros. Discovery’s deadline for first-round bid submission, and the M&A saga took another turn. For weeks, there’s been chatter of Saudi Arabia somehow getting into the mix, and now we have a clearer picture of that. Paramount is in talks with Saudi Arabia’s Public Investment Fund (PIF), the Qatar Investment Authority (QIA) and the Abu Dhabi Investment Authority (ADIA) about teaming up on a bid for all of WBD, according to people familiar with the situation.

What’s interesting is Paramount doesn’t really need the money — it’s backed by Larry Ellison, the world’s second-richest man — and the deal is more of a strategic play. Paramount partnering with the Arab funds means it’s boxing out Comcast from potentially striking a similar deal. While a Comcast source said that the cable giant has no plans to fund its bid with Saudi Arabian investment, Paramount doesn’t want to take the chance. One source told TheWrap: “If you’re David Ellison, you don’t have a choice.”

Well, that does somewhat clear up a couple of nasty rumors that broke last week that somehow the Saudis were coming in as an unlikely white knight in this saga that was creating both hope and angst among those conflicted that their best path to continued employment might lie into fully embracing an owner about as far removed from the background of Jack Warner and his less famous brothers as possible. Say what one will about the way they may treat some journalists–and if you’re an ABC reporter, you already did–but they do bring something to the table that means more to the Yosemite we have come to embrace today than that. This was a point not lost on THE STREET’s Niall Ridgley in his preview yesterday:

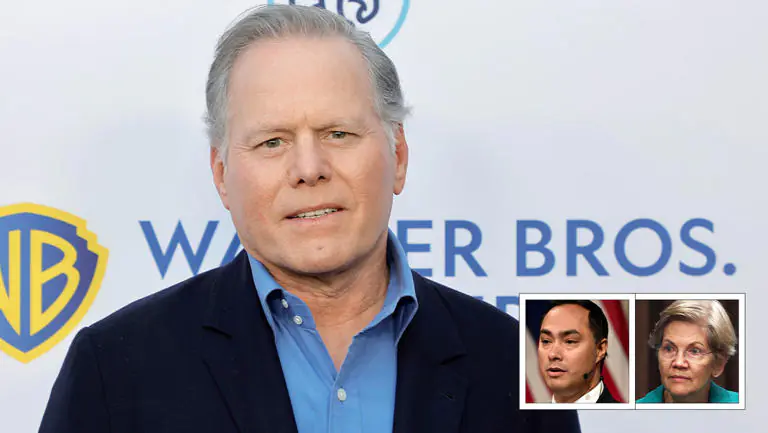

Ahead of this hullabaloo, WBD CEO David Zaslav snuck in a quick tweak to make sure he won no matter what. “The Warner Discovery CEO found time to take care of [his pay] last week,” Puck’s Matthew Belloni informed us. “[He amended] his enormous compensation package to ensure he’s duly rewarded for additional dispositions of the Warner and Discovery assets that he smashed together to leverage the 100-year legacy of the former and prolong for a few years the collapse of the latter.”

Ahead of this hullabaloo, WBD CEO David Zaslav snuck in a quick tweak to make sure he won no matter what. “The Warner Discovery CEO found time to take care of [his pay] last week,” Puck’s Matthew Belloni informed us. “[He amended] his enormous compensation package to ensure he’s duly rewarded for additional dispositions of the Warner and Discovery assets that he smashed together to leverage the 100-year legacy of the former and prolong for a few years the collapse of the latter.”

This revelation also belies the alibi that Comcast czar Brian Roberts initially cooked up a few weeks ago that indicated his absence from a high-profile dinner honoring the real Yosemite Zas at Los Angeles’ Simon Weisenthal dinner was merely poor timing for a trip that had him exclusively checking out the potential for a theme park in what is apparently becoming the Orlando of the Eastern Hemisphere, a road trip that the NEW YORK POST’s Taylor Herzlich described thusly:

Roberts visited Qiddiya, the home of a new “megacity of play” where Six Flags and “Dragon Ball Z”-themed amusement parks are being built, the source said. Those building the city are interested in a Universal theme park, but nothing has been planned yet, the source added.

Maybe that explains why Roberts was so quick to contribute to the Home Depot fund for the building of our leader’s much-desired ballroom, a topic which no doubt came up at the “modest” shindig he hosted earlier this week for the guy behind those hedge funds whose total net worth is estimated to be about $1 trillion, which Cheng further elaborated on for why David Ellison forced himself to wear a tuxedo to get a first-hand look at the renovation:

The other reason is political. President Donald Trump and Saudi Crown Prince Mohammed bin Salman are chummy, as evidenced by the warm welcome bin Salman received this week in D.C. Having the PIF as a joint investor could help Paramount ease the regulatory process even further.

Aaah…so THAT’S why you don’t “insult our guest” with inappropriate press conference questions, you heathens who don’t work for Bari Weiss. We kinda know who Fat Orange Jesus would like to see win this camel race, and it sure ain’t Mickey Mouse.

Aaah…so THAT’S why you don’t “insult our guest” with inappropriate press conference questions, you heathens who don’t work for Bari Weiss. We kinda know who Fat Orange Jesus would like to see win this camel race, and it sure ain’t Mickey Mouse.

The one entity that at the moment isn’t openly the entertainment equivalent of sportswashing is Netflix, if for no other reason than they have enough cash on hand and marketplace leverage to not need to kiss Arabian ass. But for purists and creatives who still believe that theatrical movies are at least as viable and relevant a business in this century vs. last as, say, theme parks, the spectre of a streaming-centric global behemoth who got that way via minimal (if any) first window exhibition beyond direct-to-consumer and eschewing the headache of selling content to competitors is anything but comforting. For the team that Mike DeLuca and Pam Abdy built that actually took risks to deliver a 2025 slate that delivering more than $4 billion in global box office that’s especially true.

To their end, Netflix did at least hurriedly attempt to throw a little cold water on this worry, as Reuters’ Devika Nair regurgitated early this morning:

Netflix has informed Warner Bros. Discovery management that it would continue releasing the studio’s films in theaters if its acquisition of the company succeeds, Bloomberg News reported on Wednesday. Warner Bros.’ existing theatrical release contracts would be honored, the report said, citing sources familiar with the matter Reuters could not immediately verify the report.

Netflix has informed Warner Bros. Discovery management that it would continue releasing the studio’s films in theaters if its acquisition of the company succeeds, Bloomberg News reported on Wednesday. Warner Bros.’ existing theatrical release contracts would be honored, the report said, citing sources familiar with the matter Reuters could not immediately verify the report.

That couldn’t have sat all that well with those throwing a lot more cold water on the possibility happening at all, which Ridgely spent far more time and effort on reporting:

Recent actions from both President Trump, as reported by AOL, and House Republicans led by Congressman Darrell Issa (R-Calif.) have turned what was just a knife fight into a game of machete twister. Interesting, but that’s only a single voice, right?

It was, until the story came back to life when Senator Robert Marshall (R-Kansas) followed suit Nov. 17 (suspicious timing) with his own letter conveying concerns about a possible Netflix-Warner Bros. deal: “Such a transaction would constitute a major vertical and horizontal consolidation in a sector that is already marked by limited competition. If Netflix reached a deal to acquire Warner Bros., it would raise significant antitrust questions that warrant especially rigorous review,” Senator Marshall wrote in his letter.

As VARIETY’s Todd Spengler penned yesterday, don’t expect plumes of white smoke to try and cut through the expected atmospheric river over Warner Ranch this afternoon:

(F)irst-round bids…would be nonbinding, sources told Variety, confirming an earlier report by the Wall Street Journal. The board is expected to meet before Thanksgiving to evaluate the offers and aims to have the process wrapped up by year-end.

For what it’s worth, Spengler does offer up this prognostication which probably won’t sit that well with the likes of Issa and Marshall:

There’s another potential scenario: one in which Netflix gets the Warner Bros. studios, to be led by Zaslav, and Comcast buys HBO Max. But this would be a logistical and regulatory minefield, and it’s not clear everyone would be on board. “Greg and Ted really want this, but Reed [Hastings, Netflix’s chairman] doesn’t want to deal with the regulatory hassles,” an industry insider says.

Amid all this, what does David Zaslav want? “Zaslav wants the biggest crown that gives him the biggest portfolio,” a well-connected exec says. In the current crucible of at least three competing bids, this person adds, he and the company’s board “might just be trying to run up the price.”

And that, sorry to say, is what’s–ahem–paramount in all of this. Saddle up, gang.

And that, sorry to say, is what’s–ahem–paramount in all of this. Saddle up, gang.

Until next time…