You may have already concluded that I’ve been particularly hard on one David Zaslav in these musings. The fact that pretty much his entire tenure as head honcho at Warner Brothers Discovery has essentially correlated with the existence of this space has helped to make him a familiar target, and the sheer number of times he seems to have made some sort of move or announcement to course correct has tended to be higher than most of his peers’. A quick Google search will reveal how often something he’s done has raised my eyebrows and on occasion my blood pressure. It’s a lot, to be sure. Imagine if I had actually worked for him.

But now more than ever it appears that what so many of us who did know Zaslav’s history and capabilities as a mid-level broadcast executive and superintendent of a once-potent group of unscripted cable networks have thought all along–at first more privately but as time ground on and the head count of talented people whose careers were upended his missteps grew–is finally being conceded by even those investors who otherwise supported him. Ol’ Yosemite was in over his head to begin with, and his motivation at every turn had little more to do with his own self-interests than anything else.

But now more than ever it appears that what so many of us who did know Zaslav’s history and capabilities as a mid-level broadcast executive and superintendent of a once-potent group of unscripted cable networks have thought all along–at first more privately but as time ground on and the head count of talented people whose careers were upended his missteps grew–is finally being conceded by even those investors who otherwise supported him. Ol’ Yosemite was in over his head to begin with, and his motivation at every turn had little more to do with his own self-interests than anything else.

If you needed any further evidence of that, the flurry of stories that came down yesterday regarding the “progress” he’s made in the fate of the studio should be more than enough. THE INDEPENDENT’s Kevin G. Perry did his best to present the facts down the middle:

Warner Bros. Discovery has officially put itself up for sale. The entertainment conglomerate owns a host of well-known brands including CNN, HBO, DC Studios and the flagship Warner Bros. movie studio.

In a press release seen by The Independent, the company announced a “review of strategic alternatives” after receiving “unsolicited interest” of both the entire company and Warner Bros. specifically. In a statement to press, David Zaslav, Warner Bros. Discovery President and CEO, said: “We continue to make important strides to position our business to succeed in today’s evolving media landscape by advancing our strategic initiatives, returning our studios to industry leadership, and scaling HBO Max globally.

Last month, shares in Warner Bros. Discovery soared by nearly 30 percent following reports that Paramount, fresh off its merger with Skydance Media, was preparing a majority cash bid to acquire the media conglomerate. . TheWarner Bros. Discovery stock price increased by a further 11% this morning, meaning the company is now valued at $50 billion. If Paramount were to secure the deal, it would bring together two of Hollywood’s most established power players — and bring CNN and CBS under the same roof.

However, there are several other potential buyers who may be interested in Warner Bros. Discovery, including Netflix and Comcast. (Zaslav) continued: “It’s no surprise that the significant value of our portfolio is receiving increased recognition by others in the market. After receiving interest from multiple parties, we have initiated a comprehensive review of strategic alternatives to identify the best path forward to unlock the full value of our assets.”

But funny how if one reads how the news is being framed by the companies supposedly involved in these “aggressive bids”, one picks up not quite the same level of appetite that the guy who bought Bob Evans’ estate would like us to believe is indeed happening:

For example, here’s how CBS NEWS’ own site–without assigning a byline–positions it:

Warner Bros. Discovery has signaled that it may be open to a sale of its business just months after announcing plans to split into two companies. Equity analysts with MoffettNathanson said potential bidders for all or parts of Warner Bros include Paramount Skydance, Comcast and Sony.

Warner Bros. Discovery has signaled that it may be open to a sale of its business just months after announcing plans to split into two companies. Equity analysts with MoffettNathanson said potential bidders for all or parts of Warner Bros include Paramount Skydance, Comcast and Sony.

And CNBC’s troika of Sara Salinas, Luke Fountain and Alex Sherman (at least they were willing to put actual names on the story) supplied a few unique addendums that seem to throw a wet blanket on Zas; enthusiasm:

WBD decided to publicly announce it has had interest from multiple parties after rejecting several different bids from Paramount and an offer from another company that was higher than the Paramount bid, according to a person familiar with the matter. It is unclear how serious potential offers outside of Paramount would be. Netflix was not interested in buying legacy media assets, but didn’t want WBD to go to another buyer at a low price, a source familiar with the matter said. While Comcast does not feel the need to do a deal, it will look at the possibility of pursuing WBD, sources close to the company told CNBC’s Julia Boorstin.

And finally, THE HOLLYWOOD REPORTER’s Etan Vlessing supplied an even more direct reality check last night straight from the mouth of someone supposedly deep into those weeds:

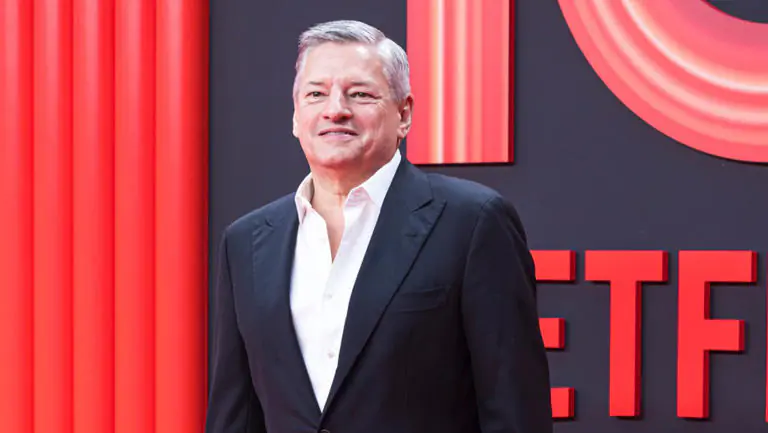

Netflix co-CEO Ted Sarandos says the streaming giant has little interest, if at all, in bidding for Warner Bros. Discovery.

Netflix co-CEO Ted Sarandos says the streaming giant has little interest, if at all, in bidding for Warner Bros. Discovery.

“Nothing is a must for us to meet our goals that we have for this business,” he said during an after-market analyst call after Netflix unveiled its third quarter financial results. Sarandos reiterated that organic growth at Netflix was preferred over big acquisitions. “When it comes to M&A opportunities, we look at them, and we look at all of them, and we apply the same framework and lens that we look at when we look to invest. Is it a big opportunity? Is there additional value in ownership,” he told analysts.

Look, no one can truly fault Zas for doing his darndest to get the best possible deal for his shareholders. And it’s not like he’s cornered the market on being a soulless aspirational media oligarch. The storm clouds gathering around the Paramount lot in the wake of news that the planned layoff of a couple of thousand who have somehow survived long enough to become Skydance chattel has been moved up to next week should tell you than anyone named Ellison isn’t likely to win any badges of honor any time soon–save, of course, for a Kennedy Center honor that for all we know has already been bought with the looming salary savings.

But like it or not, Ellison at least has a plan and a vision for whatever PSKY becomes. Even if it’s little more than the American version of PRAVDA. That’s still more of those than Zaslav has had at any point. In the wake of an inarguably successful year for the theatrical division that has almost made up for the enormous amount of unapologetic compromise he’s forced upon his TV division by installing lackeys like Gunnar Wiedenfels on top of his sports properties (which now includes Big East basketball!) and one of the least successful network executives of modern times–Channing Dungey–on top of the mostly zombie entertainment cable networks while still running the TV studio, the degree of disinterest Zaslav actually has had in defining what exactly “Disco Brothers” actually is has never been more obvious.

If you think I’m being harsh, think of the postscript that THE NEW YORK TIMES’ Benjamin Mullin and Lauren Hirsch stuck onto the tail end of their writeup:

Selling all of Warner Bros. Discovery would be a coda of sorts for Mr. Zaslav, an inveterate deal maker who has presided over a series of ever-larger mergers throughout his career. After he revamped Discovery, once a sleepy bundle of TV channels, Mr. Zaslav added Scripps Networks, a lifestyle TV juggernaut. He then added WarnerMedia. Along the way, Mr. Zaslav became a major player in Hollywood, a status he could be forced to relinquish in a sale of Warner Bros. Discovery.

Selling all of Warner Bros. Discovery would be a coda of sorts for Mr. Zaslav, an inveterate deal maker who has presided over a series of ever-larger mergers throughout his career. After he revamped Discovery, once a sleepy bundle of TV channels, Mr. Zaslav added Scripps Networks, a lifestyle TV juggernaut. He then added WarnerMedia. Along the way, Mr. Zaslav became a major player in Hollywood, a status he could be forced to relinquish in a sale of Warner Bros. Discovery.

Mr. Zaslav has considerable financial incentives to consider a sale, however. This summer, after consulting with his longtime mentor, the media magnate John Malone, Mr. Zaslav signed a new contract that pays him millions of dollars if the company changes hands.

Perry did sound a cautionary note in his coverage:

Warner Bros. Discovery also stated that they have not set a deadline or definitive timetable for a potential sale, and that an eventual sale is not guaranteed.

I for one am hoping that’s not true. At least a portion of those who have had to endure his leadership deserve a shot at working for a company whose management wants to actually be somewhere else besides a yacht in the south of France. If the recent shenanigans of the Ellisons’ Washington buddies in needing to rehire crucial government workers after foolishly purging too many too quickly are any indication, after next week there might be some similar reconsiderations needed at Paramount.

I for one am hoping that’s not true. At least a portion of those who have had to endure his leadership deserve a shot at working for a company whose management wants to actually be somewhere else besides a yacht in the south of France. If the recent shenanigans of the Ellisons’ Washington buddies in needing to rehire crucial government workers after foolishly purging too many too quickly are any indication, after next week there might be some similar reconsiderations needed at Paramount.

The sooner we can get Yosemite Zas onto his yacht–or, better still, a slow boat to China–the better.

Until next time…

“

1 thought on “Yosemite Zas: Blowin’ It To Smithereenies?!?!”

It could always be worse, but certainly it will be no better. WBD is a stock market and business tragedy and a sale would only burden a new owner with even more debt — and that debt is killing the business now. More debt will not save the company.