I may not be the youngest or tech-savviest person with tentacles to media, but I know there are folks that are even less so in both categories. In the late oughts, an older producer excitedly trumpeted the opening of his independent shingle, cashing in on a few longtime relationships to get a little press in the process. It’s well known that when one announces the establishment of their own company, in most cases it’s a signal that they’ve reached their corporate expiration date, so it’s common courtesy to express congratulations in much the same manner that one would offer condolences. A mutual friend called this older producer to do just that and was taken aback by the outsized level of confidence he had that media conglomerates would be flocking to his doorstep for consulting projects–especially considering it had been years since he had been attached to a significant production. He began to rattle off what he perceived to be the state-of-the-art services he had to offer, building to a crescendo in the style of the experienced huckster we knew that he was. His perception of a money shot? “WE HAVE A WEBSITE!!!”. May I reiterate it was the LATE OUGHTS. His updated self-composed IMDB biography doesn’t list many clients in this century. Surprised?

I got much the same feeling when I saw the flurry of announcements that dropped yesterday surrounding Nielsen, far and away the oldest media measurement company around. BARRETT MEDIA was among the more matter-of-fact outlets that spelled out the details:

Nielsen has revealed it will end its panel-based television ratings later this year, ending a decades-long practice that served as the industry standard.

Nielsen has revealed it will end its panel-based television ratings later this year, ending a decades-long practice that served as the industry standard.

In the fourth quarter, Nielsen will stop selling its panel-based ratings, instead focusing on its Big Data + Panel measurements. Last week, the company revealed the Big Data + Panel measurements had been accredited by the Media Rating Council. The new measurement metric combines figures from the company’s consumer panel data with those supplied by third-party vendors, namely smart TV manufacturers.

The decision from the ratings agency comes after years of stating its intention to move away from the panel-based formula. In 2020, Nielsen revealed it would move away from the system by 2024. However, due to pushback from advertisers that claimed the move was rushed, the company continued to operate as normal.

To be fair, there are indeed plenty of folks that deal with Nielsen that are loathe to change, particularly when the status quo has benefitted their ability to effectively negotiate on their behalf. But even in this somewhat supportive piece was this telling button:

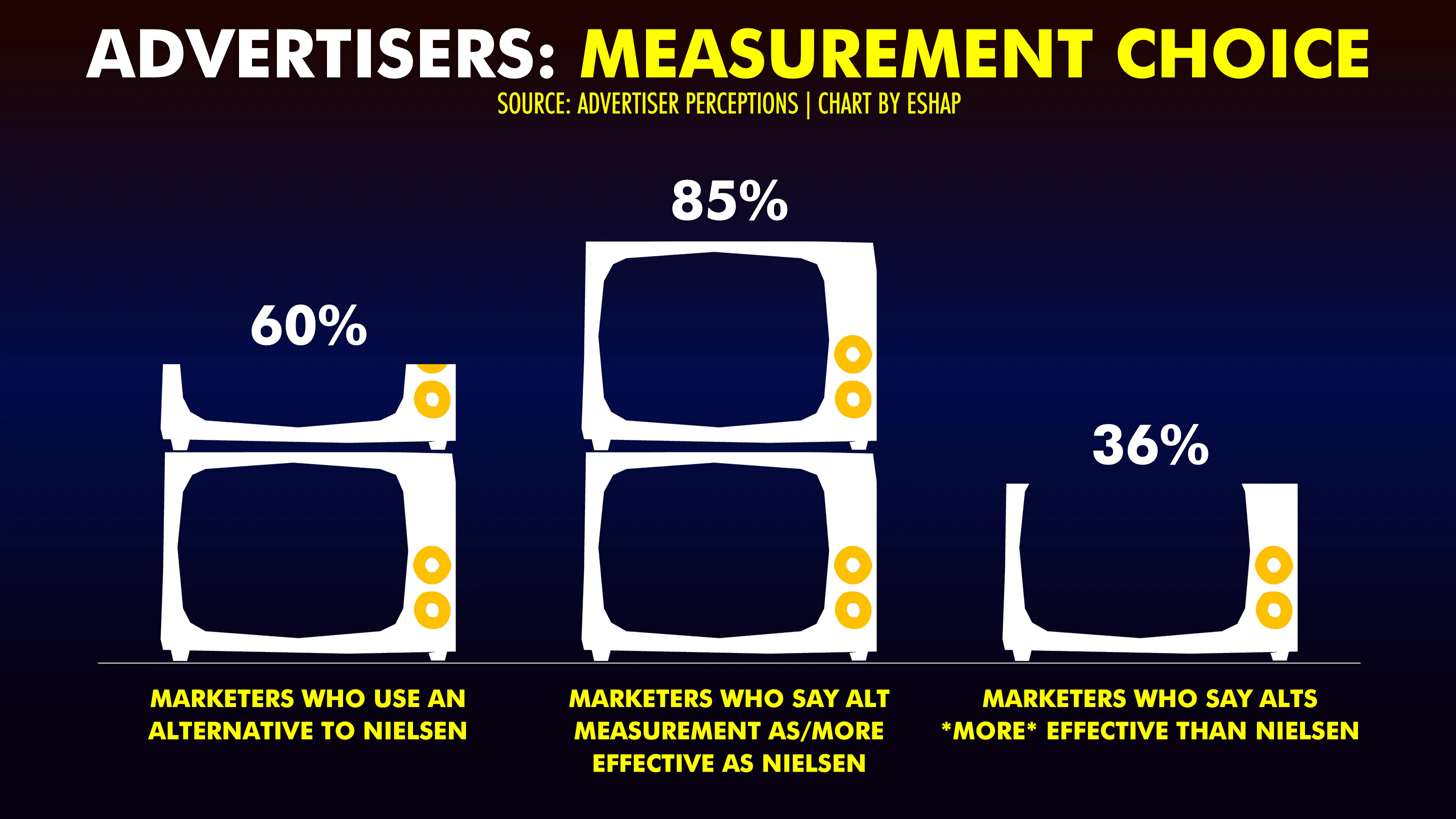

According to a survey released by Advertiser Perceptions last year, 60% of advertising firms used an alternative to Nielsen in 2024. That does not mean those same advertisers didn’t also utilize data from Nielsen, but it does show the rise of challengers to the field dominated by the company.

According to a survey released by Advertiser Perceptions last year, 60% of advertising firms used an alternative to Nielsen in 2024. That does not mean those same advertisers didn’t also utilize data from Nielsen, but it does show the rise of challengers to the field dominated by the company.

EMARKETER’s Daniel Konstantinovic dropped a few more telltale signs of the times from the same survey in his writeup:

- In a July Advertiser Perceptions survey of marketers who spend at least $250,000 annually on advertising, 37% of respondents said that connected TV and over-the-top video were better at measuring campaign effectiveness than linear TV. Other perks, like converting leads into sales (36%) and reaching high-value audiences (36%) reflect an appetite for advertising on platforms that can offer more granular insights than linear TV.

So clearly there were already significant proportions of the advertiser side of the equation that were likely not pushing back, And as Konstantinovic continued, the content side had already been well down the path of change by this point:

- Following Nielsen’s (now reinstated) loss of MRC accreditation for panel ratings in 2021, several networks called for the industry to move away from its standard and instead adopt cross-media measurement solutions that meet marketers’ evolving needs.

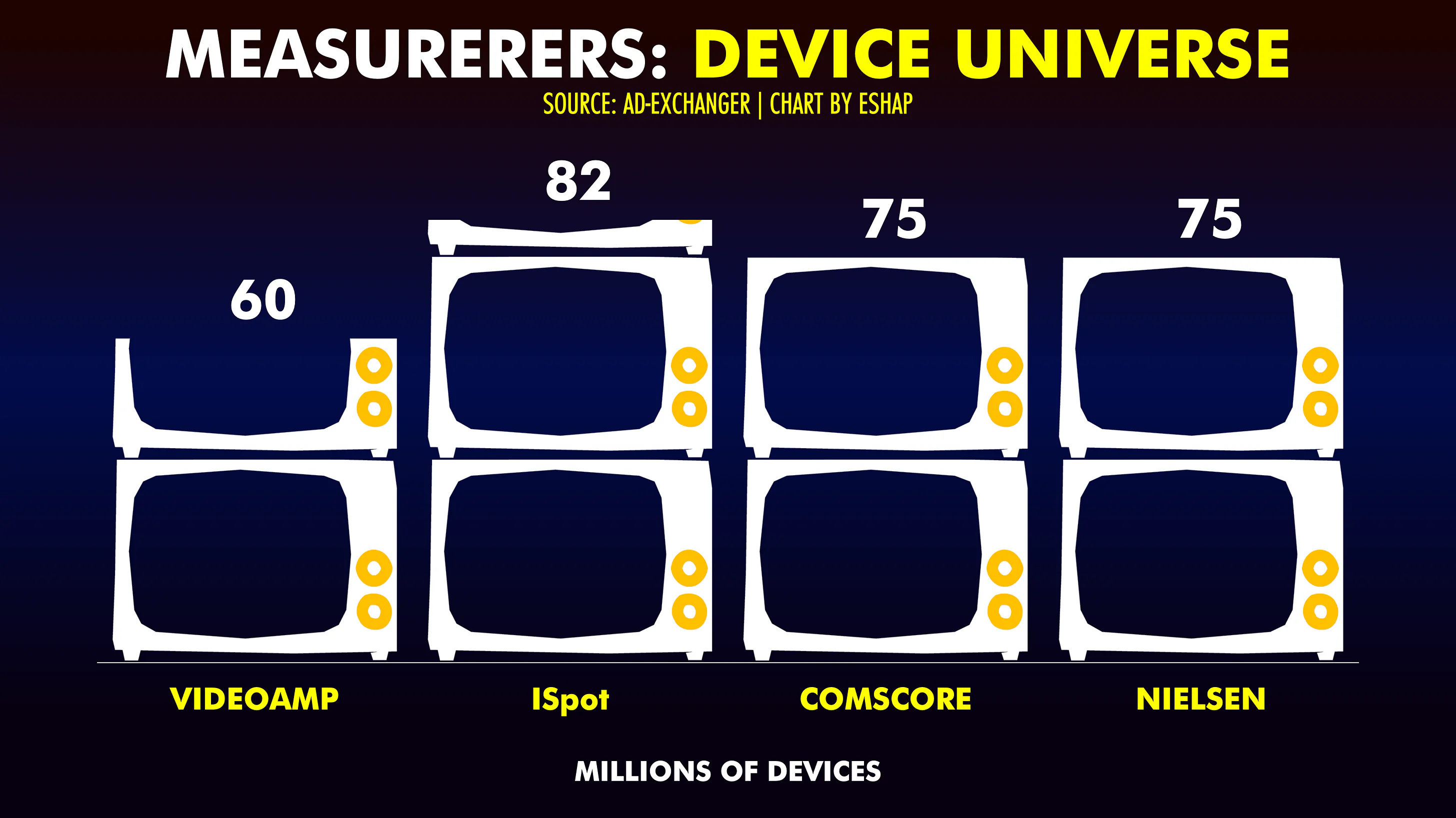

- Since then, many of those networks have formed a consortium called the Joint Industry Committee to give credibility to Nielsen competitors including iSpot, VideoAmp, and Comscore.

And as we’ve covered in previous musings ad (well, programmer) infinitum, these competitors have already made significant inroads. The ever-razor sharp and especially giddy Iggles fan Evan Shapiro dropped a few more slides from that survey into his newsletter yesterday morning and made a few observations of his own:

When you dig into the numbers, Nielsen’s “new Big Data” solution looks and feels a lot like every other big data solution out there, except later to the game and with a good deal of baggage attached. iSpot boasts a larger universe of devices and homes. Last year, Paramount divorced Nielsen, choosing VideoAmp instead. And Comscore, in addition to offering nationalized big data, covers local viewership in the biggest 210 local DMAs, whereas Nielsen does not have local measurement prowess or accreditation.

When you dig into the numbers, Nielsen’s “new Big Data” solution looks and feels a lot like every other big data solution out there, except later to the game and with a good deal of baggage attached. iSpot boasts a larger universe of devices and homes. Last year, Paramount divorced Nielsen, choosing VideoAmp instead. And Comscore, in addition to offering nationalized big data, covers local viewership in the biggest 210 local DMAs, whereas Nielsen does not have local measurement prowess or accreditation.

He also shared this nugget from THE WALL STREET JOURNAL that exemplified how other Nielsen customers have already been coping with the challenging reality of measurement as we head into the second quarter of the 21st century:

“At CES, Disney released a new ad product called Disney Compass designed to give buyers quicker and more direct access to Disney data in addition to data from Disney’s identity and measurement partners.

‘Having to buy, plan and measure through multiple vendors is too fragmented,’ said Nick Winfrey, Disney’s director of data science and strategy, and data fragmentation is a time suck for advertisers.”

‘Having to buy, plan and measure through multiple vendors is too fragmented,’ said Nick Winfrey, Disney’s director of data science and strategy, and data fragmentation is a time suck for advertisers.”

And Shapiro also shone a little light as to where Nielsen might have gotten the idea that their overcautious approach was justified:

|

Last year, I got into a bit of a pissing match with 4As (the American Association of Advertising Agencies) over their wrong-headed declaration that the industry was “not ready for a multi-currency world.” Their cold take sounded a LOT like a buggy-whip trade organization complaining about the advent of the Model T. It also was a total misread of their own members’ points of view. |

Between that and the oft-times obsessive niggliness of the MRC, the fact that it has taken until now for Nielsen to finally get to a point where the industry as a whole reached years earlier is to me clear proof that the struggles it is having to meet their aggressive financial goals is more self-inflicted than not. And the grandstanding they are exhibiting in their all-too-public showdown with Paramount Global is clearly mere saber-rattling–and it doesn’t seem to be working. Paramount seems to be content with Videoamp and, what’s more, Videoamp is now the currency of record for Netflix’s WWE ad-supported content and has quietly reached deals with other networks and platforms to be a key part of those alternative suppliers.

So it sure seems like Nielsen is coming quite late to this party, and will have an awful lot of catching up to do. One can only wish them to have more success in their quest for business than the Luddite producer we mused about earlier. But they do have an advantage over him. After all, they already have a darn good website.

Until next time…